Using Specification Analysis to Create a Marketing Strategy for Paint

Interior paints are used in every type of commercial facility. In fact, is there even one facility that does not use some type of paint on their walls or ceilings?

Interior paints are used in every type of commercial facility. In fact, is there even one facility that does not use some type of paint on their walls or ceilings?

For paint manufacturers to increase their position in the commercial market, they must continuously evaluate their presence in the designers’ specifications.

The first obstacle is that the paint market is huge. According to a recent IBISWorld[1] research report on the paint industry, there are over 1,000 paint manufacturers in the U.S., and in 2019 they will produce revenue of over $32 billion of paint.

However, this is a marked difference between the number of paint manufacturers that are specified in commercial projects, which is explored in this report. There are simply NOT 1,000 paint manufacturers in commercial specifications.

For example, in current projects going on in the US and Canada from the ConstructConnect™ database, there are 498,015 listed. If we filter for “Interior Paint” within the specifications and plans, 42,606 projects come up (that doesn’t mean the others aren’t using interior paint by the way, but that these documents call it out specifically).

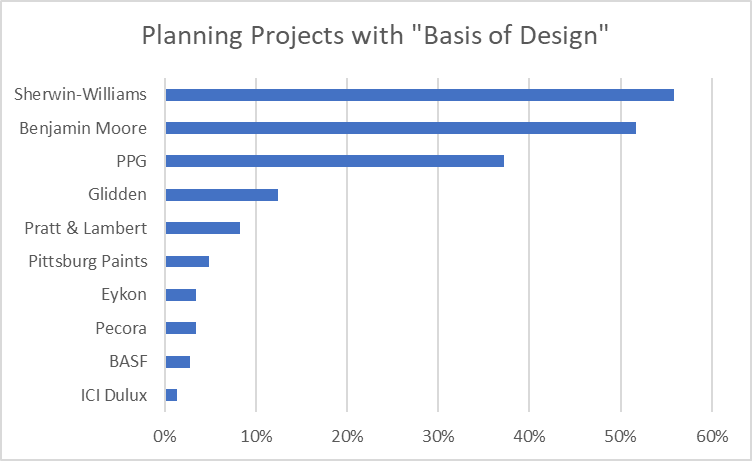

But if we add (“interior paint*” NEAR “basis of design”) to our search, we end up with 3,084 projects, of which 145 are in the planning stage. AIM identified 10 manufacturers who are specified this way in this group (shown in the chart below with the percentage of specifications where that manufacturer appears).

In other words, Sherwin-Williams and Benjamin Moore are the dominant players in the 145 projects — leaders in the market which, as you will see, are in many specifications.

This is a far cry from 1,000 paint manufacturers. And in the age of disruption, there is no doubt these 1,000 are trying to penetrate the marketplace.

So, how will the leaders hold the lead? How will the wannabes increase their share of specifications? To answer the questions, a thorough analysis of who is specifying what is required!

Besides, the paint market is expected to grow by 1.7% a year. That means companies who are not even in the current specifications will appear, sometimes from out of nowhere.

With so many paint manufacturers and so many options, it is difficult for paint manufacturers to increase their share much less hold what share they have.

There are a lot of choices, and in this digital disruptive world, consuming and creating content or finding a strategy to do that is difficult (see How Much Data Can You Eat).

One of the ways to help grow or maintain business is through specification analysis. Paint manufacturers need to understand 1)how their product is specified, 2)how they are positioned in the designers’ specifications and 3)the overall market before embarking on the right strategy to maintain or penetrate the commercial interior paint world.

Who’s Who in Specifying Paint

Is there an architect who doesn’t specify paint for his commercial project?

Probably not. But there ARE architects who specify one brand over another. Without confusing the problem (see our discussion later of who is actually specifying paint), wouldn’t it make more sense to find out which architects are specifying your competitors (or your own brand) to find the right targets for your strategy?

For example, there are 124 architects in the above group of planning projects we just listed that are specifying interior paint as basis of design. 93% of those architects are tied to a single project. That means you’d have to target a lot of architects.

But, what if you could segment that group into, say, the ones that are specifying the leaders to hatch a flanking strategy? If you did that, you would end up with a target group of 55 architects — a much easier group to handle in a sustained campaign.

Or, what if you just took the architects from the 124 group that were specifying more than one project, regardless of the paint manufacturer they were specifying? That would mean 7% – or nine firms – would be in your target group! There are many ways to fulfill your strategy! The nine architects who are specifying multiple projects by the way were the following:

- Work Architecture Company

- Corgan Associates

- Duvall Decker Architects

- KSQ Design

- McKinnell, McKinnell, and Taylor, Inc.

- MS Consultants

- Omniplan / Dallas

- Southern A & E Architects

- TAP Architecture

Are they on your “hit” list? Has your sales force called on them? Do you think the market leaders call on them? Who should you target? And why? Should the paint manufacturer leaders target all 124, or only those that are not specifying their brand? Should the wannabes target architects who specify the leaders, or others who, like them, are up-and-comers?

These are important questions to answer! Some manufacturers think targeting the largest firms is a strategy. You can see from this analysis that’s a false belief!

In fact, after you define “largest,” you’d be surprised how many other “non-large” architects should be in your sights (i.e., AECOM is one of the world’s premier infrastructure firms, delivering professional services throughout the project lifecycle and has only one of the 145 projects associated with it — not that they are not worth pursuing as a target ). But it all depends on your strategy (see Who’s On First When it Comes to Strategy for an interesting point of view)!

Remember, we were only looking at planning stage projects with a filter (“interior paint*” NEAR “basis of design”) in the above example. To truly understand how to aim and who to target for your strategy, a deeper dive would be required.

Reviewing & Maximizing the Specs

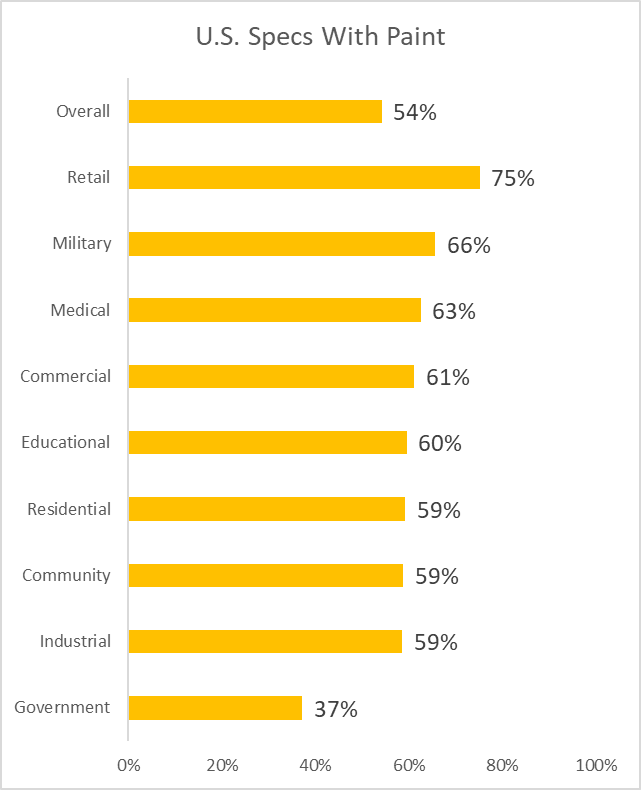

In order to increase a paint manufacturers’ chances of being specified, selected and ultimately purchased, it is important to understand how the specification process works and learn more about how architects and designers are specifying paint products. To do that, AIM looked at that specification market in 2019, when there were 100,170 projects in the U.S. with specifications, and 54% of the projects had a specification for paint in the ConstructConnect™ database of construction.

Virtually every kind of building is using paint – from schools, to retail, offices, hotels and hospitals.

Overall, over 50% of the projects had a specification for paint, with retail projects showing the highest percentage of projects at 75%.

This indicates there is a vast opportunity for paint manufacturers to begin to maximize their potential for being the brand of choice. For example, you can also target a specific market an analyze the architects doing work in THAT market!

Many manufactures work hard to get their brand in the designer’s specification and to be included in the list of approved brands (the “short list”). For other manufacturers, getting a product into the specification can be a difficult task. Architects and designers do not change or review their specs often. In research conducted and published by Architect Magazine titled The Truth About Specification[2], many times architects re-use or revise existing specifications. In addition, there are many large national established brands in the paint market which makes it difficult for new brands to penetrate the market (as seen in the earlier discussion).

Detailed analysis of the paint specifications indicates there is also a wide dispersion of how paint brands appear in the specifications. Several paint manufacturers can be listed that can be used, or can just list one brand can be listed with no substitution.

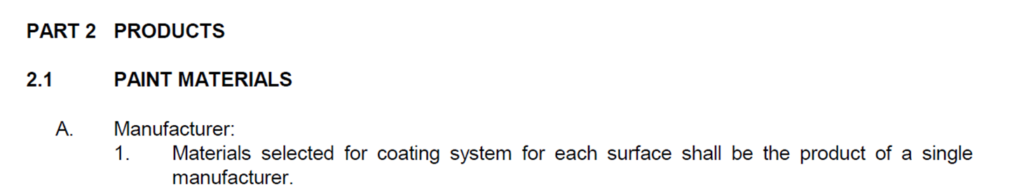

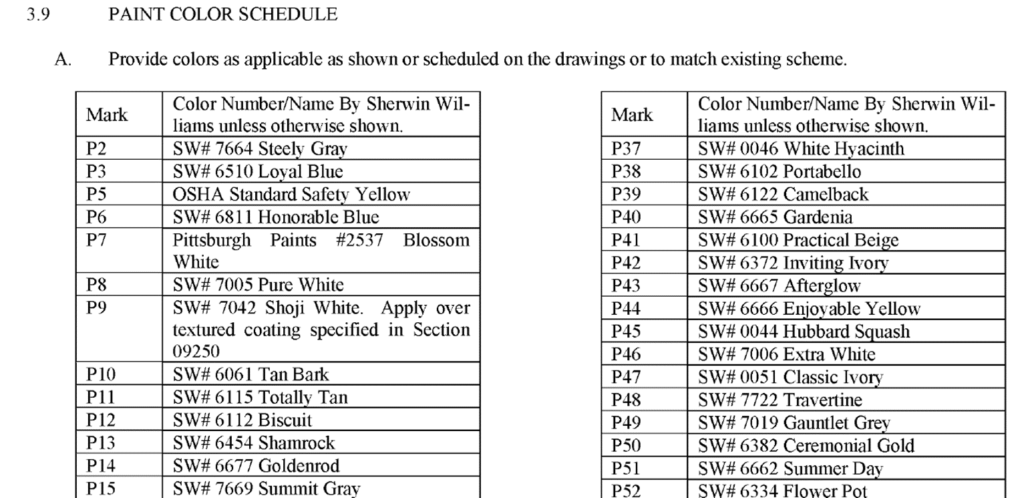

For example, in some specifications the architect requires that the contractor select any brand of paint, but all paint needs to be from a single manufacturer. Yet on other specifications, the designer may not only outline the specific brand of paint to be used but will provide extensive details on the color description and code. Many times, the brand of paint is not even in the specification but can only be found on the paint schedule in the plans. Here are a couple of examples.

Brand Preference

Accountability Information Management’s (AIM) Brand Preference Study revealed just how competitive the paint market is.

In this unaided blind brand preference study, architects and designers were asked to list their top three brands of interior paints. There were over 34 different brands or companies mentioned by architects in AIM’s proprietary research with architects that were “involved” with the specification of these products. Although the list of specific brands no doubt shifts over time, the numerous choices designers must choose from still holds true.

What’s interesting, perhaps, is that in Sweet’s today, only four (4) manufacturers are listed: Behr Process Corporation, Sherwin-Williams Company, Wooster Products, Inc., Acoustical Surfaces, Inc. Furthermore, Thomasnet lists only 13 top U.S. manufacturers, and only two of those in that list are in Sweets: Behr and Sherwin-Williams. Thomasnet also lists global manufacturers of paint as well.

Designers have lots of brand choices when it comes paint products. In fact, in the recent search of specs for interior paint, there were often 5 or six different paint brands specified with the option to mix and match brands. Oftentimes, the spec would say the brand of paint was up to the contractor as long as it met certain project or performance goals. On certain types of properties where the designer is focused on achieving a certain look or style, a more detailed specification with specific paint brands and colors will be found.

Using Spec Analysis Strengthen a Brand’s Market Position

To help paint manufacturers evaluate their brand position in the marketplace in order to determine the right strategy, it is important to also understand more about an architect’s level of involvement when specifying paint. How much control or influence does the architect or designer have on selecting a particular brand of paint?

Looking at interior paints, the architects’ involvement in specifying a specific brand or manufacturer can vary based on the project type, the owner’s requirements and the architect’s design preferences.

In AIM’s Architect’s Brand Preference research, the majority or 84% of architects surveyed indicated that they were involved in selecting and specifying the brand of paint. This was less than an earlier study where 91% of architects surveyed indicated they were involved in making brand decisions for interior paints. Does that mean someone else (i.e., interior designer) is doing the specifications?

In addition, of those that were involved in specifying paint, 10% indicated they did not have brand preference. This was a major increase since previous research which indicated only 2% had no brand preference. Brand preference is slipping.

Maybe some architects do not distinguish the difference of one brand over another? Or, is the choice being delegated to someone else in the value chain as mentioned, or simply, not relevant and left to the contractor?

While architects may indicate they have “no preference,” they are, in fact, involved in specifying and recommending interior paint. The architect will weigh in on the type of look or style they want achieve besides performance criteria.

However, due to the abundance of brand options, architects may delegate the brand selection to “others” in the specification path such as the interior designer. Many design firms today maintain a list of “approved” brands that have met specific performance and quality requirements. If a manufacturer is not on “the list,” the chance of being in a specification are limited. It is becoming increasingly important for manufacturers to expose and educate architects on their product features, benefits and other services they offer the market.

Becoming a brand on the architect’s preferred list of brands is key to impacting a brand’s position in the specifications (see What’s Love Got to Do with a B2B Brand, or our own report, What is a Brand?). To be on a firm’s list of approved paint providers, a manufacturer needs to provide more than just a quality product. They need to have a history of top performance, offer premiere service and local support for their brand.

What can paint manufacturers do to enhance brand selection and preference? How can manufacturers convert “no preference” answers into specifications and recommendations for their brands? These are important questions.

Impacting Brand Specification with the Basis of Design

To answer these questions, consider what we know about specifications. The key to gaining ground in specifications is to become part of the “basis of design”[3] or be listed as the brand of choice with no substitutions.

The “basis of design” means that the architect or designer is calling out a specific brand that is used to meet the objectives of the project. To learn more about how often “basis of design” is used in paint specs, we used ConstructConnect™, an online construction database, to get a better sense of how interior paints are specified. By searching the projects for “paint with Basis of Design” in specific years, we can see how the specification for “basis of design” and specific brands has changed.

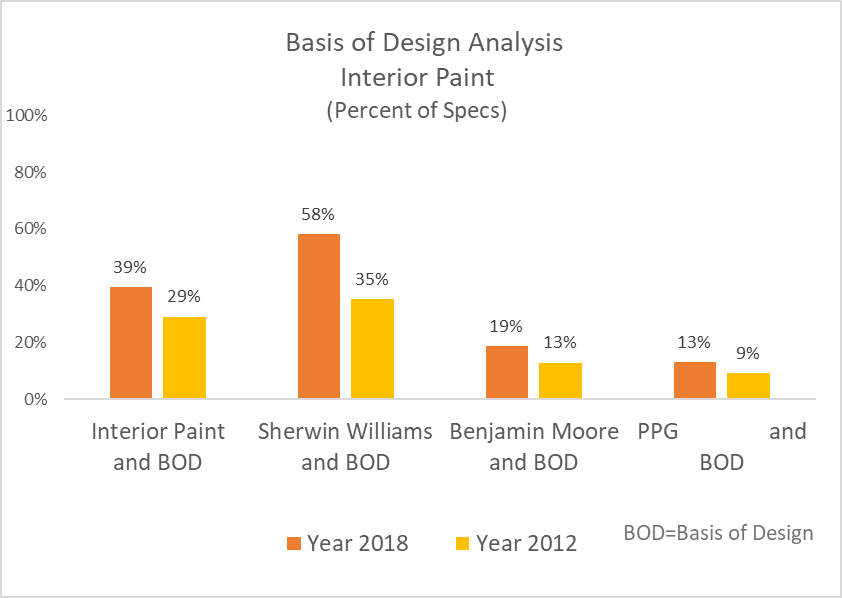

Less than half (39%) of U.S. projects in 2018 with a paint specification also included a brand as the “basis of design.” In fact, this has increased slightly since 2012 where “basis of design” was specified in only 29% of the paint specifications.

This analysis also indicates that while less than 50% of projects with a paint specification have a “basis of design” spec, there are specific brands that consistently appear as the basis of design as shown in the chart below.

Since there are a variety of different brands that are involved in providing paint products to the market, this type of spec analysis can show manufacturers how often their brand is specified as the “basis of design” and if it has shifted over a specific period of time. Note, too, how these three leaders match the earlier analysis of the 145 current projects going on in the planning stage.

Since the market is constantly changing as new and existing manufacturers introduce new products, it is important for a manufacturer to continuously review their position in the project specifications in order to have the right strategy.

While a manufacturer cannot always be sure that they are on a firm’s “preferred” list, they can evaluate how often their brand appears in the specifications and measure how often they are the “basis of the design” or appear in the project paint schedules. If a brand is found in the specifications and is the “basis of design”, they certainly are going to be on the list of “preferred” brands.

The specification analysis also indicates that in some specs a specific brand can be called out. To avoid being replaced by a “less expensive” or a “comparable” product, paint manufacturers may want to strive to be specified as the brand with “no substitutions”. In addition, having a specific paint color or finish specified on a project will increase a manufacturer’s chance of being purchased.

The same research can be done on the any other product categories or on specific brands based on the manufacturer’s needs. AIM can help you design a spec analysis to meet your objectives and look at a particular brand/manufacturer, by territory, competitors, project type, location or by spec area/schedule.

Let us know where your interests are. Thank you for reading this report, and let us know what you think!

____________________________________________________

[1] IBISWorld, Founded in 1971 provides information and market research on thousands of industries worldwide. https://www.ibisworld.com/industry-statistics/market-size/paint-manufacturing-united-states

[2] The Truth About Specification, by John Schneidawind, AIA highlights key findings on an AIA survey of 330 architects on how they select and specify building materials for commercial projects. The article stresses the importance of an architect’s relationship with building product manufacturers and report that 60% of the time the architect already knows which materials an architect is going to use. https://www.architectmagazine.com/aia-architect/aiafeature/the-truth-about-specification_o

[3]USlegal.com defines it as “Basis of design is a term used in engineering, which typically consists of text paragraphs, preliminary drawings, equipment lists, etc. Well-defined requirements consist of a set of statements that could form the basis of inspection and test acceptance criteria. The basis of design documentation and the specification identify how the design provides the performance and operational requirements of the project and its systems.”